“Understanding Insurance: A Fun Comic Guide to How Insurance Works” demystifies the often complex world of insurance through engaging illustrations & relatable scenarios. It simplifies concepts like premiums, deductibles, & covered risks, making them accessible & entertaining. Readers gain valuable insights into various types of insurance health, auto, life & their significance, empowering them to make informed decisions. This guide is a perfect blend of education & entertainment, transforming a traditionally dry subject into an enjoyable experience, & ultimately fostering a better understanding of safeguarding oneself against uncertainties.

Understanding Insurance: A Fun Comic Guide to How Insurance Works. Unlock the mysteries of insurance with our fun comic guide! Dive into how insurance works in an easy & enjoyable way. Perfect for everyone!

What Exactly Is Insurance?

Understanding insurance begins with recognizing its core purpose protection against financial loss. A concept that might seem complex at first gradually reveals itself as a fundamental aspect of daily lives. Coverage acts as a safety net, allowing individuals & businesses to mitigate risks, ensuring stability in uncertain circumstances. Numerous forms exist, from health & auto insurance, to homeowner & life insurance, each having unique terms & conditions. Whether someone finds themselves in a minor accident or facing significant health issues, having adequate insurance can greatly alleviate financial burdens.

As someone who has navigated various types of insurance, my personal experiences highlight how crucial each component becomes during unexpected events. I recall a time when my car broke down during a road trip. Thankfully, my auto insurance covered towing & repairs, which kept my vacation plans intact. This moment reinforced my appreciation for insurance, illustrating its protective role in life’s unpredictable challenges.

Various types of coverage exist, each designed for specific situations. Individuals should consider their needs, lifestyle, & financial capabilities before deciding on a plan. Not only does insurance provide peace of mind, but it also promotes responsible financial management.

Types of Insurance

Exploring different types of insurance reveals a vast landscape filled with options tailored for various aspects of life. Each insurance type addresses distinct needs, serving specific purposes while protecting against potential risks. Understanding these variations allows consumers to make informed decisions regarding coverage.

Health insurance offers protection against medical expenses, covering hospital visits, medications, & necessary treatments. This type ensures that individuals receive essential healthcare services, without overwhelming financial strain. And another thing, short-term policies exist for those needing temporary coverage, such as during transitions between jobs.

Auto insurance acts as a safeguard for car owners, shielding them from expenses arising from accidents, theft, or damages. Policies can include liability coverage, collision, & comprehensive plans, ensuring adequate protection in various situations. As car maintenance & repair costs continuously rise, having robust auto insurance becomes increasingly vital.

Homeowners & Renters Insurance

Homeowners insurance provides coverage for property & personal belongings against unforeseen disasters such as fire, theft, or natural calamities. This form of insurance safeguards against significant financial loss, ensuring homeowners remain secure despite unexpected events. Meanwhile, renters insurance extends similar protections for individuals leasing properties, securing personal belongings during incidents.

Life insurance serves as a financial safety net for dependents, ensuring they remain supported even after an unexpected loss. Offering peace of mind to policyholders, this insurance can provide funds for daily expenses, educational needs, or mortgage repayments. Understanding different life insurance policies, including term & whole life options, allows individuals to choose least appropriate for their circumstances.

And don’t forget, liability insurance protects individuals or businesses against claims resulting from injuries or damages. This type of coverage proves invaluable for both personal & professional environments, particularly for those hosting gatherings or operating businesses. By safeguarding against lawsuits & compensation claims, liability insurance plays a crucial role in overall financial planning.

How Insurance Works

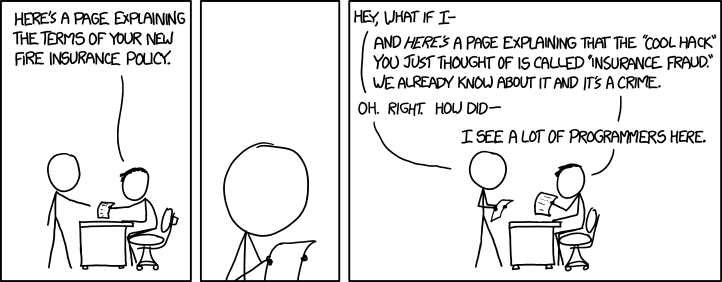

Understanding how insurance operates requires diving into its mechanisms, which can initially appear convoluted. At its core, insurance involves pooling resources from multiple policyholders, redistributing funds during claims to mitigate individual risks. This mutual support ensures that when one individual faces a loss, others contribute economically, creating a safety network.

The initial stage involves purchasing an insurance policy, where individuals select plans based on personal needs, risks, & budget. A premium, paid monthly or annually, secures coverage while allowing claims to be made when necessary. Premiums vary according to factors such as coverage amount, deductibles, & risk assessments, influencing total costs.

Claims processing forms another essential component of insurance operation. After experiencing an insured event, policyholders file claims with their respective insurance companies. Claims adjusters evaluate these submissions, determining validity & establishing necessary payouts. This systematic approach ensures funds are available for those facing challenges, reinforcing insurance’s protective features.

Understanding Premiums & Deductibles

Poor comprehension of premiums & deductibles can lead to unhappiness regarding insurance choices. Understanding these concepts ensures individuals can select policies that align with their financial situations. Premiums represent regular payments made in exchange for coverage, while deductibles signify out-of-pocket expenses that must be paid before insurance kicks in.

A fundamental aspect involves recognizing that higher premiums typically correlate with lower deductibles. Conversely, opting for lower premiums often results in higher deductibles. Eventually, individuals must assess their financial capability & risk tolerance, determining which arrangement suits them best. Making informed decisions ultimately leads to better satisfaction with insurance policies.

On top of that, examining how different factors influence premiums can shed light on potential savings. Insurance companies consider various aspects, including age, driving record, health history, & even credit scores, while determining rates. By understanding these criteria, individuals can make strategic decisions for maximizing benefits & minimizing costs.

The Importance of Insurance

Recognizing insurance’s significance in everyday life highlights its invaluable role in financial security. By proactively investing in coverage options, individuals & businesses can protect themselves from unforeseen events that could result in devastating consequences. Understanding this concept encourages responsibility & preparedness when facing risks.

Insurance offers peace of mind, allowing individuals to navigate life with confidence, knowing that they possess a safety net should something go awry. Whether dealing with unexpected medical bills, car accidents, or property damages, insurance plays an essential part in helping policyholders regain stability. This protective mechanism underscores the importance of assessing one’s needs, capabilities, & potential risks.

And don’t forget, businesses benefit greatly from adequate insurance coverage. By securing liability, property, & employee-related insurance, organizations shield themselves from potentially crippling legal claims. A good policy instills confidence in business owners, enabling them to focus on growth while knowing they possess a protective shield against uncertainties.

Common Myths About Insurance

Dispelling common myths about insurance helps individuals make sound decisions free from misconceptions. Many people harbor misunderstandings that result in poor choices when selecting coverage. Addressing these myths provides clarity for consumers, ensuring they understand insurance’s true nature.

One prevalent myth suggests that insurance coverage remains uniform across all providers. In reality, policies vary significantly based on multiple factors, such as company practices, state regulations, & risk assessments. As a result, obtaining multiple quotes from various providers often leads to discovering potential savings or better coverage options, debunking this common misconception.

Another widespread belief centers on the idea that insurance only serves as an added expense. While it’s true that premiums represent an immediate cost, viewing insurance as an investment emphasizes long-term returns. In times of crisis, having adequate coverage provides assurance that financial burdens become manageable. Understanding this fact encourages individuals to reevaluate their attitudes toward insurance.

How to Choose the Right Insurance Policy

Selecting an insurance policy that best fits individual needs results from careful assessment & understanding of various factors. First & foremost, individuals should analyze their specific requirements & risks. Grasping personal situations such as financial obligations, personal belongings, & health conditions plays a crucial role in determining appropriate coverage.

Next, conducting thorough research remains essential before making any decisions. Comparing different policies allows individuals to evaluate premium costs, coverage limits, & deductibles. Online tools & resources streamline this comparison process, empowering consumers with knowledge required to navigate complex decisions regarding insurance.

Lastly, seeking the advice of professionals can provide invaluable insights. Insurance agents possess expertise across different policies & can guide consumers through their options. Equipping oneself with such resources enhances confidence, resulting in smart selections that align with individual situations & financial capabilities.

Budgeting for Insurance Costs

Budgeting for insurance costs can prove daunting for some. Be that as it may, implementing effective strategies allows individuals & families to incorporate premiums into their overall financial plans. Understanding which expenses constitute necessary insurance coverage makes managing finances easier while ensuring adequate protection.

Initiating this process requires individuals first to analyze their income & expenses. Ensuring that premiums fit comfortably within a monthly budget remains essential. Planning for initial costs, such as deductibles or co-pays, also contributes significantly to a sound financial strategy. By accounting for these expenses, consumers can avoid strained finances while still securing necessary coverage.

And another thing, examining potential discounts can aid in reducing insurance costs. Many providers offer discounts for bundling multiple policies, maintaining a good driving record, or implementing safety measures at home. Identifying these opportunities ultimately aids potential savings in the long run.

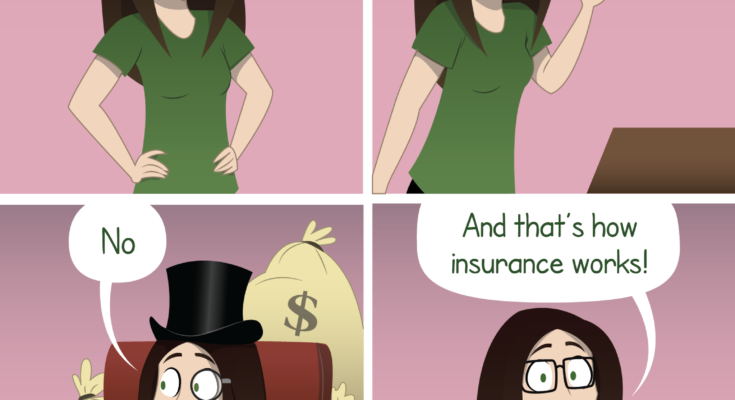

Benefits of Using Comics in Insurance Education

The integration of comics into discussing complex subjects like insurance revolutionizes educational methods. Comedic illustrations simplify intricate concepts, making them accessible & engaging. Utilizing humor & visuals enables easy understanding while capturing attention, fostering a desire for continued learning.

Meanwhile, comics often stimulate emotions & foster connections with audiences. Relatable characters experiencing real-world challenges allow readers to empathize, making educational aspects stick more effectively. This approach not only entertains but also informs, ensuring a comprehensive understanding of vital subjects.

On top of that, comics serve as a gateway for engaging diverse audiences. Whether targeting children, young adults, or professionals, incorporating humor breaks barriers, encouraging discussions about insurance that might otherwise contribute to discomfort. Such innovations broaden awareness, ultimately leading to improved understanding of insurance-related subjects.

Learning from Comic Strips

Comic strips enrich educational experiences through presenting lessons in a relatable format. Illustrated narratives create opportunities for readers to reflect on personal situations while discovering essential insurance concepts. Each illustrated panel can demonstrate consequences associated with different choices, reinforcing key messages throughout.

And don’t forget, teaching through comic strips fosters active engagement. Readers become participants in the learning journey, encouraging deeper comprehension & retention of information. This experience transforms otherwise dry topics into relatable narratives, enabling discussions regarding insurance & its relevance.

By relating insurance principles through comic storylines, educators can inspire curiosity about financial literacy, risk assessment, & economic responsibility. Creating this environment propels readers toward better decision-making & empowers them with knowledge to navigate their insurance needs efficiently.

Coverage Under a Comic Lens

When exploring insurance through comic lenses, visuals convey key messages while simplifying intricate ideas. Captivating illustrations illustrate various insurance situations, allowing readers to grasp critical lessons through entertainment. Events unfold as characters navigate challenges such as accidents, illnesses, or property loss, exemplifying how insurance can mitigate risks.

And don’t forget, comics make it possible to address common pitfalls & misconceptions associated with insurance. Engaging narratives encourage critical thinking about personal choices & highlight potential consequences of inadequate coverage. This method ultimately promotes a proactive approach towards seeking necessary protection.

Readers can learn valuable lessons while enjoying humorous illustrations. Imaginative depictions of insurance topics invite reflection & foster a better understanding of overall concepts. Educators should utilize these creative mediums to emphasize financial literacy, cultivating a generation adept at handling personal finances & insurance needs.

Essential Insurance Terms to Know

Familiarity with essential insurance terms enhances individuals’ comprehension of policies & coverage. Understanding these terminologies lays the foundation for making informed decisions regarding insurance selection. By recognizing crucial concepts, consumers become empowered to ask pertinent questions, ensuring clarity when navigating policies.

Terms such as “premium,” “deductible,” “exclusion,” & “coverage limit” are fundamental components of insurance. Before purchasing any policy, grasping these definitions plays a pivotal role. For instance, knowing that exclusions indicate specific circumstances or events not covered by a policy enables consumers to choose wisely.

On top of that, understanding “copay” & “coinsurance” presents consumers with necessary insight regarding health coverage. These concepts delineate how costs are shared between insurers & policyholders. Understanding these responsibilities can prevent individuals from facing unexpectedly high medical expenses at inopportune times.

| Insurance Term | Description |

|---|---|

| Premium | Regular payment made for insurance coverage. |

| Deductible | Out-of-pocket expense before insurance coverage begins. |

| Exclusion | Specific scenarios not covered by a policy. |

- Claim – Request for payment from insurer.

- Co-pay – Fixed payment for specific healthcare services.

- Coinsurance – Percentage of costs shared between insurer & policyholder.

- Underwriting – Process of evaluating risk associated with insuring a person or property.

- Beneficiary – Person designated to receive insurance payout in case of loss.

Key Insurance Vocabulary

| Type of Insurance | Main Feature |

|---|---|

| Health Insurance | Covers medical expenses |

| Auto Insurance | Protects against vehicle-related risks |

| Life Insurance | Provides financial support to beneficiaries |

Understanding such terminology nurtures individual confidence in insurance decisions, paving the way for smart financial management. Clarity in definitions ultimately leads to responsible decision-making during times of unpredictability.

“Empowering individuals with insurance knowledge transforms passive consumers into informed stewards of their financial security.”

- Comprehensive Coverage

- Collision Coverage

- Personal Injury Protection

- Deductible Adjustments

- Liability Protection

Understanding Common Coverage Options

The Future of Insurance Education

Anticipating future advancements in insurance education remains essential as society evolves. Technology drives new methods & mediums for delivering crucial financial information, such as through interactive platforms & gamified learning experiences. These innovations empower individuals, reinforcing essential concepts while engaging them in meaningful discourse.

On top of that, future insurance education initiatives should focus on cultivating a culture of financial literacy across demographics. Ensuring that everyone regardless of age possesses adequate knowledge of insurance benefits serves dual purposes: fostering responsible financial habits while safeguarding communities. This approach encourages discussions surrounding insurance, resulting in a more informed public.

Finally, community outreach efforts can further enrich this educational landscape. Engaging individuals through workshops, webinars, & forums promotes an understanding of insurance that transcends traditional formats. Employing creative strategies ensures that diverse audiences grasp essential lessons while dispelling myths surrounding various insurance types.

Conclusion

In this lively journey through the world of insurance, we’ve uncovered how it works in a way that’s easy & fun! Understanding insurance doesn’t have to be boring or complicated. With our comic guide, you’ve learned the basics, like why you need it & how it protects you. Whether it’s health insurance, auto coverage, or anything in between, knowing what you’re getting into helps you feel more secure. So next time you think of insurance, remember that it’s all about keeping you safe while adding a little fun to your financial planning!