Ensure your insurance coverage includes protection against winter hazards like snow, ice, & storms. Review your homeowner’s policy to verify it covers damages from falling trees or roof collapses. Consider adding comprehensive auto insurance to guard against winter-related accidents & roadside emergencies. Keep an inventory of your personal property for claims, & ensure your liability coverage is adequate in case of accidents on your property. Lastly, maintain clear communication with your insurance agent to stay updated on any changes or additional coverage options as the season progresses.

Essential Winter Insurance Tips: Protect Your Assets This Season. Stay safe this winter with our essential winter insurance tips. Learn how to protect your assets & navigate seasonal challenges with ease!

Understanding Winter Risks

Winter can bring its fair share of challenges. Snow, ice, & colder temperatures pose significant risks, potentially impacting personal safety & property. Understanding these risks helps individuals prepare effectively & safeguard their assets.

Insurance coverage during winter months becomes crucial. Homeowners & vehicle owners alike must consider potential damage caused by harsh weather conditions. Preparing beforehand allows for better protection choices & minimizes financial loss when unfortunate events occur.

Adapting personal insurance strategies according to winter challenges not only ensures peace of mind but also can save money down road. Taking proactive steps allows individuals coverage tailored specifically for winter-related incidents.

Winter Preparation Tips for Homeowners

Homeowners should increase diligence during winter months. Inspecting property for vulnerabilities before cold sets in works wonders. Key areas include roofs, gutters, pipes, & insulation.

Failing to address these areas may lead to serious repercussions, ranging from roof leaks due to melting snow to frozen pipes bursting. These incidents can inflict significant damage & trigger costly repairs, affecting both homeowners & insurance claims.

And another thing, investing in proper supplies like roof rakes & salt for driveways may reduce hazards. Homeowners should also remain vigilant about snow accumulation on roofs. Accumulation can lead to excess weight, which poses risks for structural integrity.

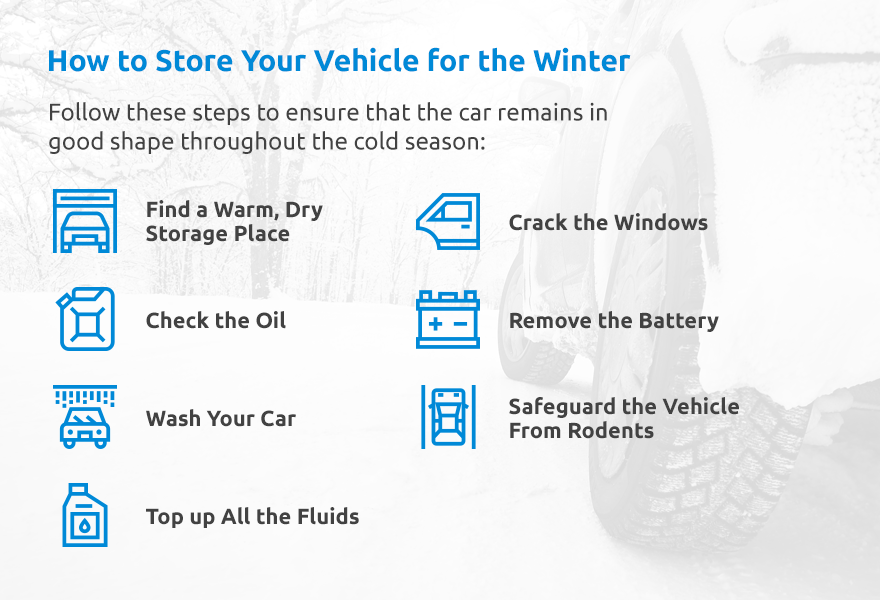

Tips for Vehicle Insurance During Winter

Winter weather complicates driving conditions, increasing risks of accidents. Ensuring vehicle insurance coverage reflects this reality holds paramount importance. Comprehensive coverage protects against damages due to weather events like hail, ice, or snow.

Maintaining a clean driving record during winter conditions not only keeps individuals safe but also lowers premium costs. Insurance providers often reward customers who demonstrate responsible behavior behind wheel, reflecting positively on their policies.

And another thing, consider enhanced coverage options for cars stored outside during winter months. Comprehensive plans protect against snow-related damages, while also ensuring financial security in case of accidents.

Reviewing Insurance Policies Annually

Annual reviews of insurance policies remain vital, particularly during seasonal changes. Winter-related risks may highlight coverage gaps within existing policies. Homeowners should familiarize themselves with coverage limits, deductibles, & specific winter-related incidents covered.

Updating policies according to current needs ensures adequate protection against potential risks. This includes provisions for snow-related damages or incidents stemming from winter weather conditions.

Consulting with an insurance agent provides insights & recommendations tailored specifically toward individual circumstances. Agents possess extensive knowledge on best practices in ensuring comprehensive coverage, leading to better financial protection.

Coverage for Personal Property

Understanding personal property coverage during winter months maintains significant relevance. Items stored outdoors or in garages face heightened risks of damage due to temperature fluctuations & moisture accumulation.

Purchasing additional coverage for specific items susceptible to winter hazards can serve beneficial. Homeowners should assess belongings, making adjustments reflective of current values. This adjustment helps avoid underinsurance, particularly during winter months when risk factors elevate.

On top of that, documenting personal property through photographs & receipts proves essential. In case of damage from winter storms or related events, having records expedites claim processes & provides clarity when addressing potential disputes with insurance providers.

Insuring Against Natural Disasters

Natural disasters often occur during winter months, leading individuals to assess their insurance protection strategies. Flooding from melting snow or heavy rain can inflict significant damage, warranting considerations on flood insurance.

Homeowners should know whether their policies encompass flood protection. Many standard home insurance policies exclude floods, making it necessary for individuals residing in high-risk zones to acquire separate flood insurance policies.

These policies serve as a safety net during unexpected natural disasters. Homeowners must review local weather patterns & historical data, making informed decisions regarding sufficient coverage tailored to their specific geographic regions.

Preventing Ice Dams

Preventing ice dams requires proactive measures, as they pose substantial risks to homes, particularly roofs. These formations occur when melting snow refreezes, creating barriers that lead to water leakage inside homes.

Addressing insulation & ventilation within attics remains crucial. Proper insulation helps maintain consistent heat, reducing chances for snow melting & subsequently refreezing, preventing costly damages & claims.

Regularly clearing gutters & downspouts assists with minimization of ice dam formation. Homeowners should prioritize these maintenance tasks throughout winter, ensuring that downspouts direct water away from foundations.

Winter Safety Recommendations

Awareness regarding winter safety remains essential for preventing accidents & injuries. Individuals should prioritize safety measures within their homes & while driving. Simple actions can significantly mitigate risks during snowy conditions.

Keeping walkways clear of snow & ice prevents slips & falls, making homes safer for residents & visitors alike. Salt or sand can provide traction during icy conditions, facilitating safer movement around properties.

For drivers, maintaining a winter emergency kit within vehicles significantly enhances safety. This kit should consist of essential items such as blankets, food, water, flashlight, & first aid supplies. Being prepared equips individuals for potential roadside emergencies during winter months.

Updating Homeownership Policies for Rental Properties

Individuals renting out properties should assess their insurance policies during winter months. Rental properties require adequate coverage, particularly against potential winter hazards affecting both property owners & tenants.

Securing appropriate liability insurance remains paramount. This coverage protects owners against claims made by tenants due to accidents or damages stemming from winter incidents, providing peace of mind.

And another thing, homeowners should also inquire about coverage for personal belongings that tenants may have. Ensuring comprehensive protection for both property & occupants fosters strong landlord-tenant relationships while protecting individual investments.

Essential Checklists for Winter Insurance

Homeowner’s Insurance Checklist

- Inspect roof for vulnerabilities

- Review insulation in attics

- Check gutters & downspouts

- Update insurance policy details

- Document personal property thoroughly

Vehicle Insurance Checklist

- Review comprehensive coverage options

- Maintain a clean driving record

- Assess risks when parking outside

- Keep emergency kit in vehicle

- Ensure tires are winter-ready

Rental Property Insurance Checklist

- Review liability coverage options

- Ensure tenants possess renter’s insurance

- Update documentation for rental property

- Maintain property regularly

- Establish clear communication with tenants

Winter Maintenance & Insurance Savings

Investing in winter maintenance not only enhances safety but can also lead to insurance savings. Policies often reward responsible homeowners who take steps toward minimizing risks associated with winter hazards.

Regular inspections & maintenance help prevent significant damages, ultimately leading to fewer claims. Lower claims history qualifies homeowners for premium discounts, positively impacting overall financial health.

On top of that, keeping up with local building codes may influence insurance decisions. Adhering maintains safety standards while potentially lowering premiums, proving mutually beneficial for all parties involved.

| Action | Benefit |

|---|---|

| Regular roof inspections | Prevent costly repairs |

| Good insulation | Reduce heating costs |

| Emergency kits in vehicles | Enhance roadside safety |

Considerations for Home-Based Businesses

Individuals operating businesses from home should evaluate existing insurance during winter months. Business-related incidents fall outside conventional homeowner’s policies, requiring specific business insurance coverage.

Ensuring protection against potential winter hazards protects both business assets & income during challenging weather conditions. This includes securing appropriate liability coverage & safeguarding equipment from elements.

On top of that, accounting for any changes in personal property can benefit businesses. Reviewing business assets annually allows for adjusting coverage according to changes in value or quantity, ensuring adequate financial protection.

“Proactive risk management during winter ensures everyone remains protected against unforeseen events & liabilities.”

Understanding the Claims Process

Familiarizing oneself with claims processes ahead of time remains crucial for quick recovery after winter incidents. Knowing how to navigate insurance claims minimizes stress & helps expedite recovery efforts.

Homeowners should document all damages, assembling records such as photographs & receipts during claim processes. Keeping communication open with insurance agents allows individuals better understand their options, ensuring smooth progression of claims.

And another thing, understanding specific timelines associated with winter-related claims helps manage expectations. Agents often outline procedures & anticipated timelines, allowing homeowners to remain informed throughout the process.

| Claim Process Step | Description |

|---|---|

| Document damages | Create a detailed list of all losses |

| Contact your agent | Inform them of incidents promptly |

| File a claim | Submit all required documentation |

Conclusion

To stay safe this winter, remember these **essential winter insurance tips**. Start by reviewing your **insurance policy** to ensure it covers winter risks like snow damage or freezing pipes. Don’t forget to check your deductibles & adjust them if needed. Also, make sure to document any property you own, as it can help with future claims. Keeping your home well-maintained can prevent costly damages, too. By following these simple steps, you can effectively **protect your assets** this season. Stay warm, stay safe, & ensure your peace of mind during the chilly months ahead!